You are here

Back to top

Newsletter

March 2023 - Utilizing The Power Of Multi-pay (English Only)

IMPACT OF RISING INTEREST RATE

An increase in the interest rate has an immediate impact on the loan, resulting in a higher amount of repayment. Clients who are considering premium financing may encounter the following issues when it comes to rising interest rates:

- Diminishing effect on leveraging

- Concerns on interest rate volatility

- No more ‘cheap’ money

- Outstanding loan will be deducted from the death benefit payout

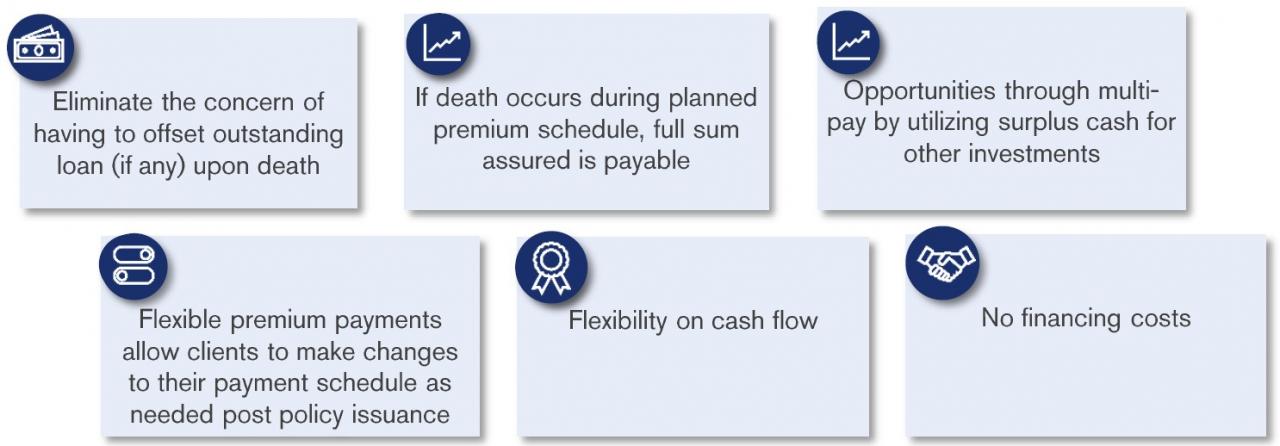

WORRY LESS WITH A MORE FLEXIBLE PAYMENT APPROACH

Multi-pay premium approach is an alternative option to pay for an insurance policy over a period of time, rather than paying the full premium upfront. This payment option allows clients to better manage personal or business cash flow and leverage capital to meet other investments or business needs.

UTILIZING THE POWER OF MULTI-PAY

CASE STUDY

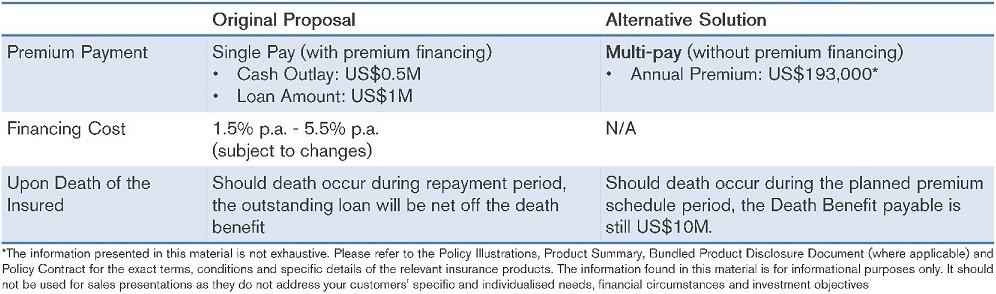

Mr Lo would like to optimize his wealth to leave a legacy for his children and to possibly have more accessible funds for other investments. He is considering an indexed universal life insurance product with US$10M death cover for wealth transfer planning.

However, Mr Lo has concerns about interest rate volatility. He is uncertain about how much loan interest he has to pay, and how he should plan his cash flows to fund it.

Disclaimer

This presentation has been prepared using the information believed to be reliable at the time of preparation, it may not be and is not to be construed as an offer to place or arrange insurance in respect of any parties. This is intended for educational / reference purposes and nothing contained in this presentation may be construed as investment, tax or legal advice in respect of any jurisdictions or counterparties. We strongly recommend an independent assessment of the specific legal, regulatory and tax consequences in relation to presented transaction. This advertisement has not been reviews by the Monetary Authority of Singapore.